Guest post written by our Editor-in-Chief Max Zamkow, Managing Partner of Third Act Ventures.

Most people assume that “Medicare” and “Innovation” go together like oil and water, and up until a few years ago that was pretty accurate. The only Agetech success in this space was the free gym membership program Silver Sneakers, founded all the way back in 1992, and which took 30 years and the conglomeration of many organizations to achieve unicorn status.

Recently, we’ve started to see a shift in Medicare’s willingness to innovate, partnering with outside organizations to test new models for improving care and decreasing costs. This has caused a veritable explosion in the number of Agetech companies selling into, or being reimbursed by, Medicare. Fueling this are venture firms investing millions of dollars into these startups whose business models only became possible just a few years ago.

Medicare is poised to be Agetech's biggest growth sector in 2023 and beyond.

Third Act Ventures we will of course continue investing across the entire landscape of Agetech, but we'll be paying extra attention to these startups that are serving Medicare populations.

In this article I’m going to dive into the two major changes that opened the floodgates and highlight the high-level opportunities they’ve created. In the future I’ll be going deeper into the individual sub-sectors, examining the present solutions and the gaps that remain.

Change #1: Expanded Medicare Advantage Benefits

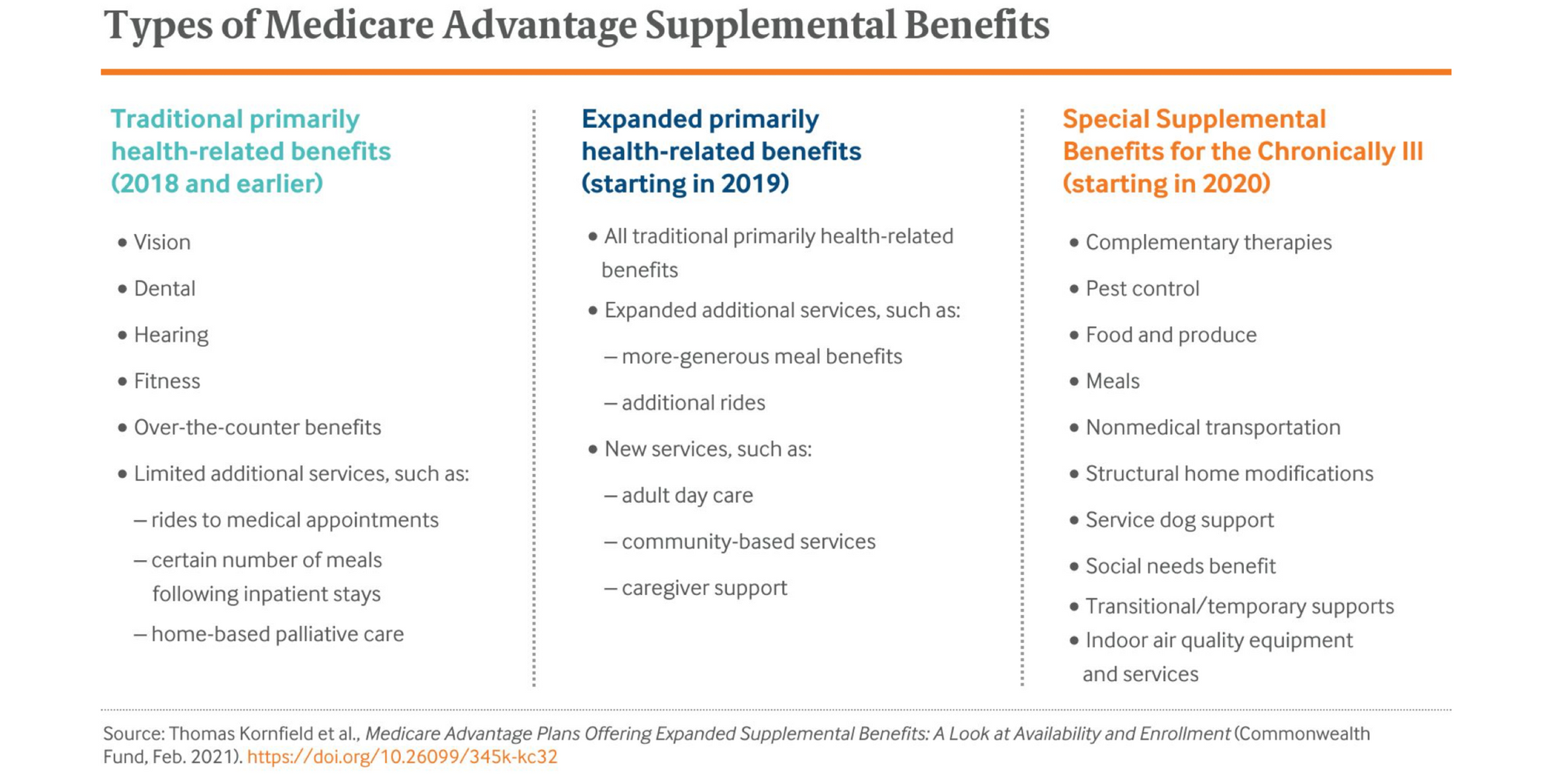

Five years ago, MA plans were only legally allowed to offer supplemental benefits - services not covered by traditional fee-for-service Medicare - that were “primarily health related” such as dental, vision, and hearing. Then in April 2018, the Centers for Medicare & Medicaid Services (CMS) decided to reinterpret the definition of “primarily health related”, broadening its scope. As guidance, they listed new services that were now allowed, including adult day care services, home health care, caregiver support services, transportation, and even bathroom safety devices.

CMS also reinterpreted the uniformity rule, which required that any benefit a MA plan offered be offered to every enrollee “uniformly”, regardless of need. Unable to limit the scope to only those with true medical needs, offering more tailored benefits fiscally impossible. CMS’s reinterpretation allows plans to target specific benefits to enrollees with similar clinical conditions, giving them the flexibility to offer specialized benefits to only those who need them. These benefits must still be applied “uniformly” to all enrollees with the same condition, but now MA plans don’t have to offer things like transportation services to those without mobility challenges.

Concurrently, by successfully passing the Bipartisan Budget Act of 2018 Congress also approved the CHRONIC Care Act, a provision of which established a new category of supplemental benefits called Special Supplemental Benefits for the Chronically Ill (SSBCI). In addition to similarly allowing the specific targeting of benefits by condition, it also explicitly removed the restriction of needing to be primarily health-related, opening up the ability to assist with non-medical needs, which we now call the Social Determinants of Health.

The table below summarizes these changes and the different categories of benefits that MA plans can now offer.

Change #2: Remote Care Reimbursement

In the late 1990s, CMS permitted the reimbursement of telehealth in only very specific cases - primarily rural settings without access to adequate healthcare resources. Without any real pressure to change, for the next 20 years those restrictions remained mostly intact. Telehealth was still early in terms of general adoption and mostly targeted to working-age adults, not the Medicare population. Additionally it was assumed that older adults neither wanted nor had the ability to successfully use it.

Then COVID-19 hit. Now it wasn’t just rural populations that were unable to access healthcare, it was everyone. In response CMS temporarily expanded the coverage and reimbursement of telehealth services. Not only did they start allowing a wider range of services to be provided via telehealth, they also relaxed restrictions on where and how these services could be provided.

The response was overwhelming, and surprising to many, as older adults quickly adapted, learning how to use zoom and other services. It became clear that the telehealth “genie was out of the bottle”, and so CMS moved to codify the new rules permanently. The CMS 2021 Final Rule significantly expanded the use of telehealth services, allowing for more than 80 additional services to be provided via telehealth, including certain office visits, mental health services, and therapeutic services. Additionally, the rule eliminated the restriction of only providing telehealth in rural areas.

It didn’t stop there, the CMS 2021 Final Rule went even further to include and expand coverage for remote patient monitoring (RPM) services. It allowed providers to be reimbursed not just for the time spent directly with patients on video visits and calls, but also for time spent monitoring and reviewing data sent asynchronously - an absolute necessity for RPM’s ability to catch and prevent issues before they happen. It also allowed for the reimbursement of the devices, used by the patient in their home, necessary to collect and transmit information to their providers.

Finally the pieces were put in place to enable effective remote care.

The Floodgates are Open

As soon as they got the green light, MA plans started hungrily adding new services to its benefits offerings. With so many of the new benefit and reimbursement categories being outside their wheelhouse, MA plans had to look externally to find products and services to partner with. Since many of the categories that were brand new, they didn’t have large incumbent organizations that plans could work with, the only options were startups. So not only are MA plans now working with a larger number, and variety, of external organizations, but they’re also working with companies significantly younger and less proven than before. Previously payors wanted to see years of studies and outcomes data before they were willing to consider using a new service, but with these brand new categories of benefits they were forced to break down these barriers and work with early-stage startups.

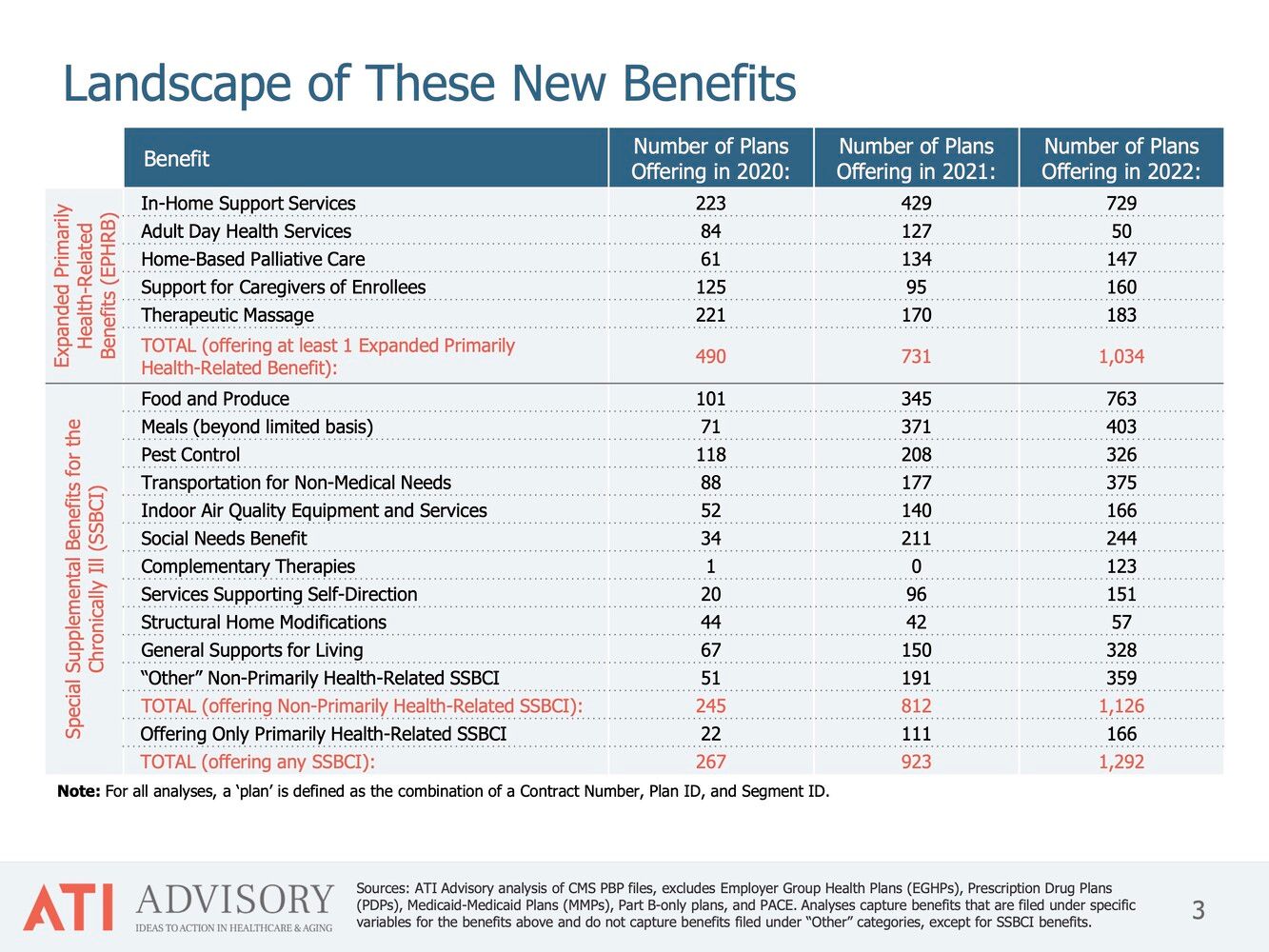

As the table below from leading research firm ATI Advisory shows, the number of MA plans offering expanded benefits has grown exponentially since 2020.

These changes have already minted one agetech unicorn, Papa. The “grandkids-on-demand” service started by selling directly to consumers, appealing to long-distance caregivers looking to assist with basic care and home maintenance from afar. While finding success and growing at a decent rate, it wasn’t until Papa pivoted to selling into Medicare Advantage that its utilization, and valuation, exploded. While family caregivers appreciate the assistance and the peace-of-mind it brings, it’s the health insurers who truly reap the financial rewards of keeping beneficiaries in their homes, and out of the hospital, longer.

While Papa was one of the first companies that blew past a $1B valuation thanks to Medicare, it certainly won’t be the last. As I mentioned previously, Third Act Ventures will be spending a lot of our time this year diving deeper into the Agetech for Medicare ecosystem, exploring each of the different types of benefits and the startups working within. We'll be sharing our findings as we go, so stay tuned.

Join us at Medicarians, April 24-26 at the MGM Grand, Las Vegas

This year, Third Act Ventures and Agetech News are helping organize the Medicarians conference. Sponsored by major health plans, this event brings together MA Product & Plan Providers as well as Brokers, Agencies & Distribution Partners, all looking to stay on the cutting edge. This year we’re joining the team to help them dive deeper into the intersection of Agetech x Medicare. We’ve invited Agetech innovators and investors to the mix to talk about these new opportunities - what’s working, what isn’t, and what’s still unsolved.

If you’re involved in (or don’t want to miss out on) Agetech in Medicare, you should be at Medicarians. Feel free to reach out for more information.