Combination CVS and Oak St. Health

CVS is aggressively executing on its ambitious plans to capitalize on senior care. A year after acquiring Oak St. Health for $10.6 billion, the company is now actively merging the brand with its retail pharmacies to create a one-stop shop for care and medications. Twenty-five of its pharmacy storefronts are already in the process of turning into combination pharmacy and senior primary care centers, with the goal of having over 300 of such locations by the end of 2026.

What’s especially impressive (or perhaps foolish) is how this expansion is pressing on despite recent setbacks by its competitors. Walgreens attempted a similar concept with VillageMD, a move they are now seriously regretting, while Walmart just closed all of its 51 in-store clinics.

CVS, however, possesses a unique advantage in Aetna. By combining a health insurance plan (Aetna), a pharmacy network, and primary care centers, CVS can offer a more seamless and coordinated healthcare experience. This integrated approach not only prevents errors and improves outcomes but also has the potential to lower the cost of care.

This strategy is further enhanced by the ability to seamlessly cross-promote the other offerings. Imagine receiving discounts on CVS purchases as an Aetna member or being directed to the Oak St. Health desk during a pharmacy visit because "you seem unwell." The convenience of it all may make it an almost irresistible offering.

For some reason, writing this has gotten an obscure observational comedy song from 2010 stuck in my head. Hopefully CVS will fare better than they did…

🎵 I'm at the CVS (what?) 🎵

🎵 I'm at the Oak St. Health (what?) 🎵

🎵 I'm at the combination CVS and Oak St. Health 🎵

Lyrics adapted from "Combination Pizza Hut and Taco Bell" by Das Racist

On Sunday October 20th, payors, providers, entrepreneurs, and investors will converge on Vegas for the biggest healthtech conference of the year. On day one, Agetech will be taking over the Everest stage, and I'm thrilled to be moderating the opening session.

This is a historic moment for Agetech. Don't miss this opportunity to connect with industry leaders, learn about the latest innovations, and be part of the future of healthcare.

Join me for a thought-provoking discussion on Sunday, October 20th at 12:50-1:30 PM. Secure your ticket now and use code 24HSG_250 for $250 off.

August Highlights

Flo Health, a women's health app supporting women throughout their health journey from menstruation to menopause, has raised over $200 million in a Series C funding round. This makes them the first purely digital consumer women's health app to achieve unicorn status. (Femtech Insider)

Devoted Health, a Medicare Advantage plan and provider operating in 13 states, secured $112 million to expand into an additional 7 states. (BioTech Networks)

🎉 Care.ai, a developer of AI-enabled ambient monitoring systems, was acquired by Stryker, a medical device and equipment manufacturer, for an undisclosed amount. This acquisition aims to bolster Stryker's ability to help healthcare systems combat staffing shortages and improve workplace safety. (Fierce Biotech)

Vesta Healthcare, a technology-enabled home care provider focused on integrating caregiver insights into the care team workflow, raised $65 million in a Series C funding round. The use of funds was not disclosed. (Business Wire)

Butlr, a sensor technology startup specializing in motion and behavior sensing in buildings, secured $38 million in a Series B round. They aim to alleviate staffing shortages in senior living facilities by providing real-time, non-invasive resident monitoring. (Forbes)

🎉 Access2Care, a provider of non-emergency medical transportation services, was acquired by competitor MTM for an undisclosed amount. This acquisition is aimed at expanding MTM's reach and enhancing its ability to provide transportation solutions to a broader range of clients. (Accesswire)

PayZen, a healthcare fintech company specializing in "Care Now, Pay Later" solutions, raised $23 million in a Series B funding round, along with $200 million in debt financing. While the use of funds wasn't disclosed, the company reports that its clients typically experience a 35% increase in collections rates. (TechCrunch)

GuideHealth, a platform supporting value-based care with care coordination and AI-based care need prediction, secured $14 million in seed funding. The funding will be used to enhance its technology and continue improving Arcadia’s MSO, which the company acquired last December. (Fierce Healthcare)

Solace Health, a healthcare navigation platform that provides personalized care plans and support for patients, raised $14 million to expand its platform and enhance its capabilities. (Wall Street Journal)

Mindset Care, a tech startup streamlining the social security benefits application process for individuals and their caregivers, secured $13 million. The funding will be used to expand into partnerships with community and large-scale organizations, including local mental health nonprofits, government agencies, and homeless shelters. (Pulse 2.0)

🎉 Together Senior Health, the developer of the first scientifically validated virtual therapeutic for cognitive decline, was acquired by Linus Health, a leader in early detection of cognitive decline and dementia, for an undisclosed amount. The acquisition strengthens Linus Health's offerings by combining its expertise in early detection with Together's management solution. (HIT Consultant)

GeoH, a provider of software solutions and tech-enabled services for the homecare industry, raised $3 million to expand its homecare software technology and services. (HomeCare Magazine)

Curamatic quietly raised $3 million for its population health software designed for value-based care organizations. (SEC)

Vedapointe, a SaaS platform helping providers navigate value-based care, quietly secured $2.7 million in funding. (SEC)

Friend, the creator of a $99 AI-powered necklace designed to combat loneliness, raised $2.5 million at a $50 million valuation. The company has also begun taking pre-orders for the device, with an expected shipping date in the new year. (TechCrunch)

🎉 Numera, a PERS provider, was acquired by Malar Group, a conglomerate spanning telecommunications, IT, entertainment, software, and testing, for an undisclosed amount. The acquisition aims to strengthen Malar Group's commitment to providing innovative healthcare solutions and expands its offerings in the health and wellness market. (Business Wire)

Around the World

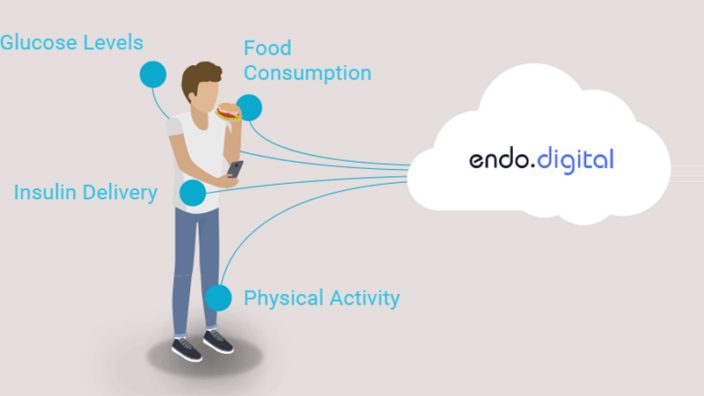

DreaMed Diabetes, a Tel Aviv, Israel-based startup specializing in AI-driven diabetes care solutions, secured a $3 million funding round. The funding will be used to expand operations in the US and support its recent agreements with Abbott and Yale New Haven Health. (The SaaS News)

Elevate Your Brand

Looking to reach a highly engaged audience of Agetech industry leaders, investors, and entrepreneurs? Sponsoring Agetech News is the perfect opportunity to increase your brand visibility. Reach out to learn more.

Thanks to our Supporters