Payors as VCs

If Family Feud asked one hundred people how they would describe the venture landscape in 2023, the number one answer would without question be: "down". Funding is down, deal flow is down, overseas investment is down. The only thing "up" this year has been layoffs, especially in tech.

However, subscribers to this newsletter know that this hasn't been the case for Agetech. We've seen multiple billion dollar acquisitions, startups raise over $100m pre-launch, and plenty of early-stage deals. In previous editions I've expanded upon some of the explanations for this including the high level of public funding, the transition to value-based care and hospital-at-home, and the increased attention being paid to mental health. A major factor we have not yet directly addressed, as exemplified by this month's deals, is the involvement of health insurers in venture.

Not only have payors been making sizable acquisitions, but they've also been making large mid-to-late stage venture investments, more than making up for any pullback from VCs. This month's top deal, Main Street Health's $315m round, is a perfect example - its investor list reads like a who's who of health insurers: CVS (Aetna), UnitedHealthcare, Centene, Humana, and Optum.

I'm not going to opine on the reasoning behind this, I'll leave that to the experts. Instead I'm simply going to thank them for the work they're doing to support Agetech and encourage them to keep it up, which, according to the rumblings heard around HLTH, they plan to do.

This month's newsletter is sponsored by the seed-stage, Agetech-focused venture capital firm Third Act Ventures: . Having invested in 38 Agetech startups and counting, Third Act Ventures is the most prolific private investor in the space. For more information on what it takes to join the portfolio or to get involved visit thirdact.vc

October Highlights

Main Street Health, which focuses on improving the quality of life for seniors living in rural areas through personalized, in-home care, raised $315 million to expand its services into 26 additional states. (PR Newswire)

🎉 BrightMD, a provider of virtual care automation solutions, was acquired by Evernorth, a health services portfolio of Cigna for an undisclosed amount. The acquisition is aimed at enhancing Evernorth's MDLive virtual care experience by streamlining the care delivery process and improving patient outcomes. (PR Newswire)

Corridor, a revenue cycle management services and coding solution for post-acute care, was acquired by WellSky for an undisclosed amount. The acquisition expands WellSky's comprehensive services to include including medical coding, clinical documentation review, billing, and collections. (WellSky)

Waymark, which automates administrative tasks for health plans, raised $42 million in fresh funding, including an investment from CVS Health. The funds will be used to train a new community health workforce, expand PCP capacity, and ultimately deliver on their charter to improve access and quality of care for people receiving Medicaid. (Fierce Healthcare)

Home Care Delivered, a provider of diabetes, incontinence, wound, urological and ostomy supplies, purchased the DMEPOS supplier business unit of Medline Industries for an undisclosed amount. The acquisition will enhance HCD's market presence, expand its geographical footprint and provide access to a broader customer base. (HME News)

Health Data Analytics Institute, which uses explainable machine learning to quantify population risks and pinpoint actionable opportunities, raised $31 million to among other things complete its implementation at Houston Methodist and Cleveland Clinic. (PR Newswire)

🎉 Cantata Health Solutions, a provider of revenue cycle and electronic health record software for senior living and rehab facilities, was acquired by PE firm TT Capital Partners, for an undisclosed amount. TT Capital hopes to use the acquisition to compete against legacy EHR vendors in this space. (PRWeb)

Hallmark Health Care Solutions, a provider of workforce management solutions for healthcare organizations, raised an undisclosed amount of capital to accelerate its growth, expand its product offerings, and enhance its customer support services. (Yahoo Finance)

SafeRide Health, a tech-enabled services platform that provides non-emergency medical transportation, raised $21 million to expand its operations and enhance its technology platform. (Pulse 2.0)

Greater Good Health, a healthcare company focused on addressing the primary care crisis and advancing value-based care for seniors, raised $20 million to enhance its technology platform, expand its team, and increase its market presence. (Business Wire)

Sage, which developed an operating system for senior living and skilled nursing facilities, raised $15 million in a Series A funding round to enhance its product development and expand its team. (Published by Axios)

Ventricle Health, a virtual cardiology clinic that uses technology to provide comprehensive heart care, raised $8 million in seed funding to expand its telemedicine services and build out its technology platform. (Axios)

Thoughtful, an app focused on combating loneliness by helping users better connect with current friends and family, raised $7 million in seed funding. (Axios)

RadiantGraph, an AI startup specializing in patient engagement for payors, raised $5 million to enhance its platform and secure additional partnerships. (Axios)

Lonely AI, founded by the former CEO of Tinder, which focuses on combating loneliness with an AI chatbot, raised $3.9 million to enhance the development and deployment of its AI and expand its reach to more users. (TechCrunch)

Prevounce Health, a provider of remote care management software, devices, and services, raised an additional $2.5 million Series A to enhance its platform and expand its sales and marketing efforts. (FinSMEs)

Dwellr, a Nebraska-based startup focused on transforming the search for senior care, raised a $500 thousand pre-seed round to enhance its platform and expand nationwide. (Published by MarketWatch)

🎉 SageHome, a leading provider of smart home solutions, raised an undisclosed amount of capital to accelerate its merger and acquisition pace, starting with Safe Showers, a company specializing in senior-friendly bathroom modifications. (GlobeNewswire)

🎉 Oasis Senior Advisors, which provides free, personalized senior living solutions, was acquired by SilverAssist. The acquisition is part of SilverAssist's strategy to expand its portfolio of solutions and enhance its ability to connect seniors with the right services. (PR Newswire)

🎉 Ride Designs, a developer of innovative wheelchair cushions, was acquired by Sunrise Medical, a major mobility equipment manufacturer. Financial details of the deal were not disclosed. (HomeCare Magazine)

Around the World

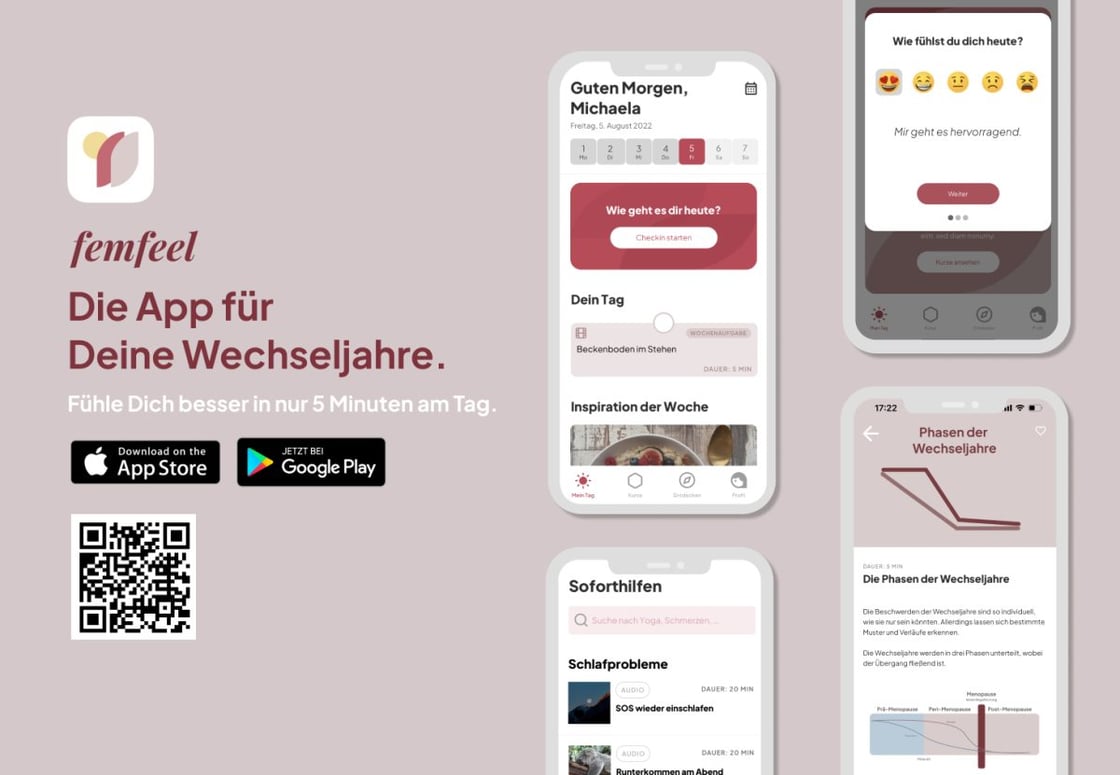

🎉 FemFeel, a UK-based digital health startup focused on women's health and wellness, was acquired by Medice Health Family, a German pharmaceutical company specializing in family health, for an undisclosed amount. The acquisition is aimed at expanding Medice's digital health portfolio and strengthening its commitment to women's health. (FemTech Insider)

Sky Labs, a South Korean company specializing in the development of cardio-cerebrovascular disease detection devices, raised KRW 20.7 billion in Series C funding to accelerate its global business expansion and enhance its R&D. (FinSMEs)

Galeneo Health, a Madrid-based startup specializing in managing off-site hospitalization services, raised €1 million to enhance its platform and expand its services. (Published by EU-Startups)